Fillable Online CA8480 - Application for repayment of Class 2 NIC - Michael Hoy Fax Email Print - pdfFiller

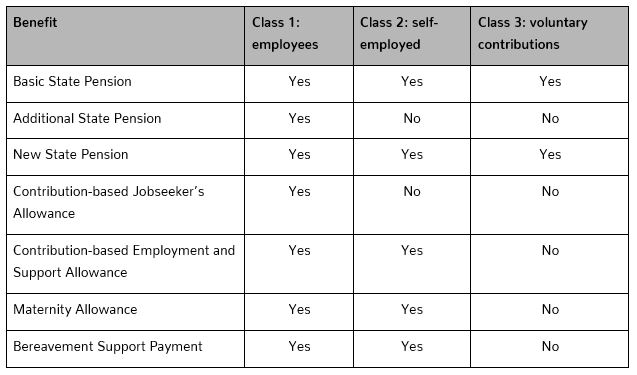

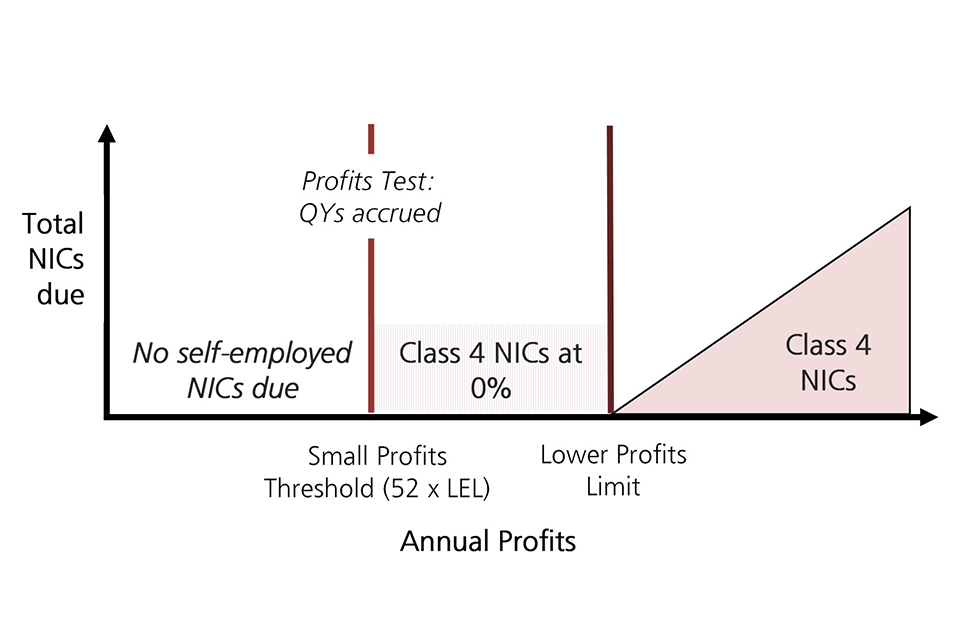

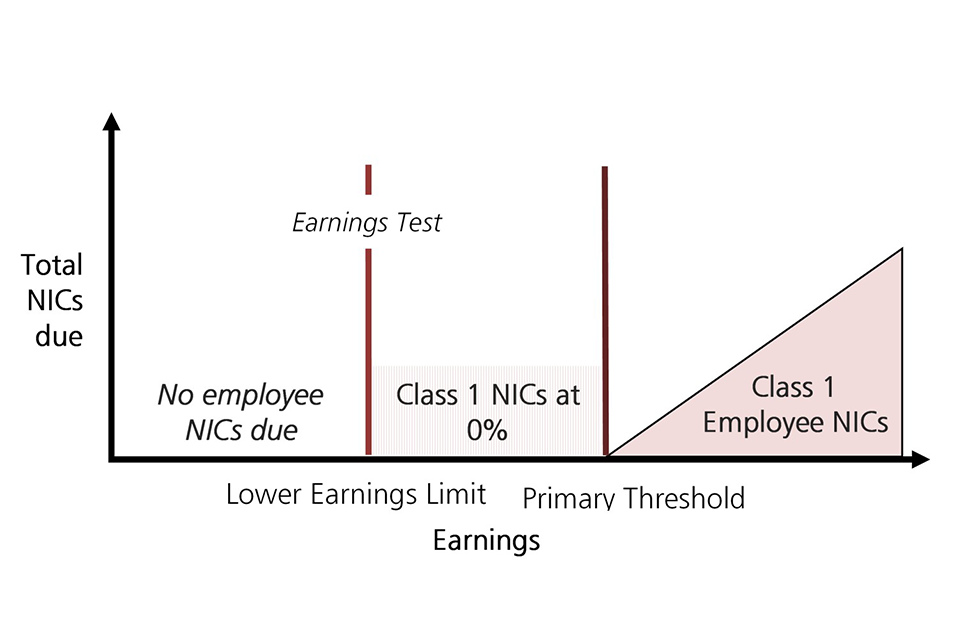

The abolition of Class 2 National Insurance: Introducing a benefit test into Class 4 National Insurance for the self-employed - GOV.UK

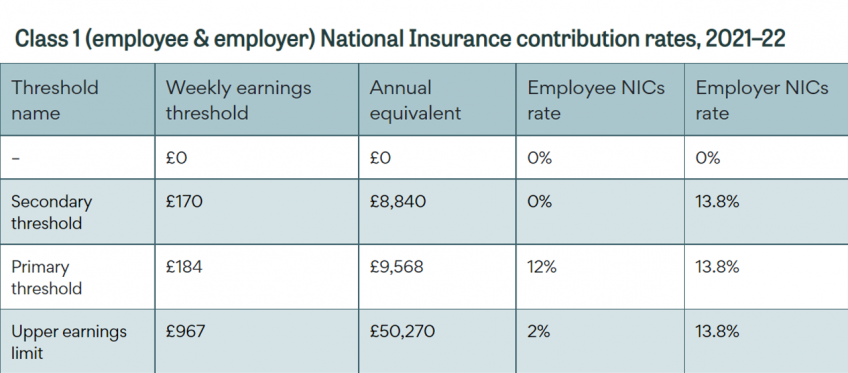

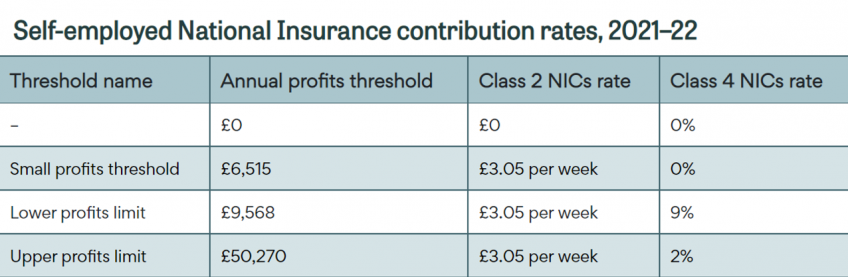

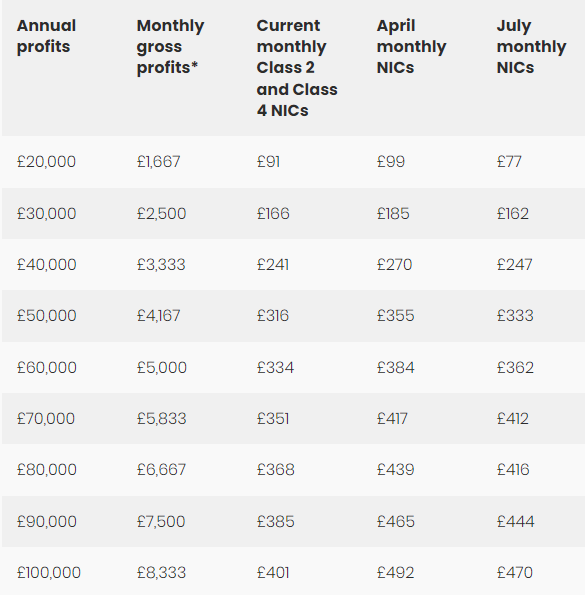

SAS Accounting Services Ltd | Guide to the National Insurance Contribution Increases from April 2022

Information from HMRC - Self-employed Class 2 National Insurance contributions (NICs) due Stock Photo - Alamy

Take action if you filed your 2019/20 tax return after 31 January 2021 and paid voluntary Class 2 National Insurance contributions | Low Incomes Tax Reform Group

The abolition of Class 2 National Insurance: Introducing a benefit test into Class 4 National Insurance for the self-employed - GOV.UK