Closed-form pricing formulas for variance swaps in the Heston model with stochastic long-run mean of variance | SpringerLink

The CTMC–Heston model: calibration and exotic option pricing with SWIFT - Journal of Computational Finance

Mathematics | Free Full-Text | A Closed-Form Pricing Formula for Log-Return Variance Swaps under Stochastic Volatility and Stochastic Interest Rate

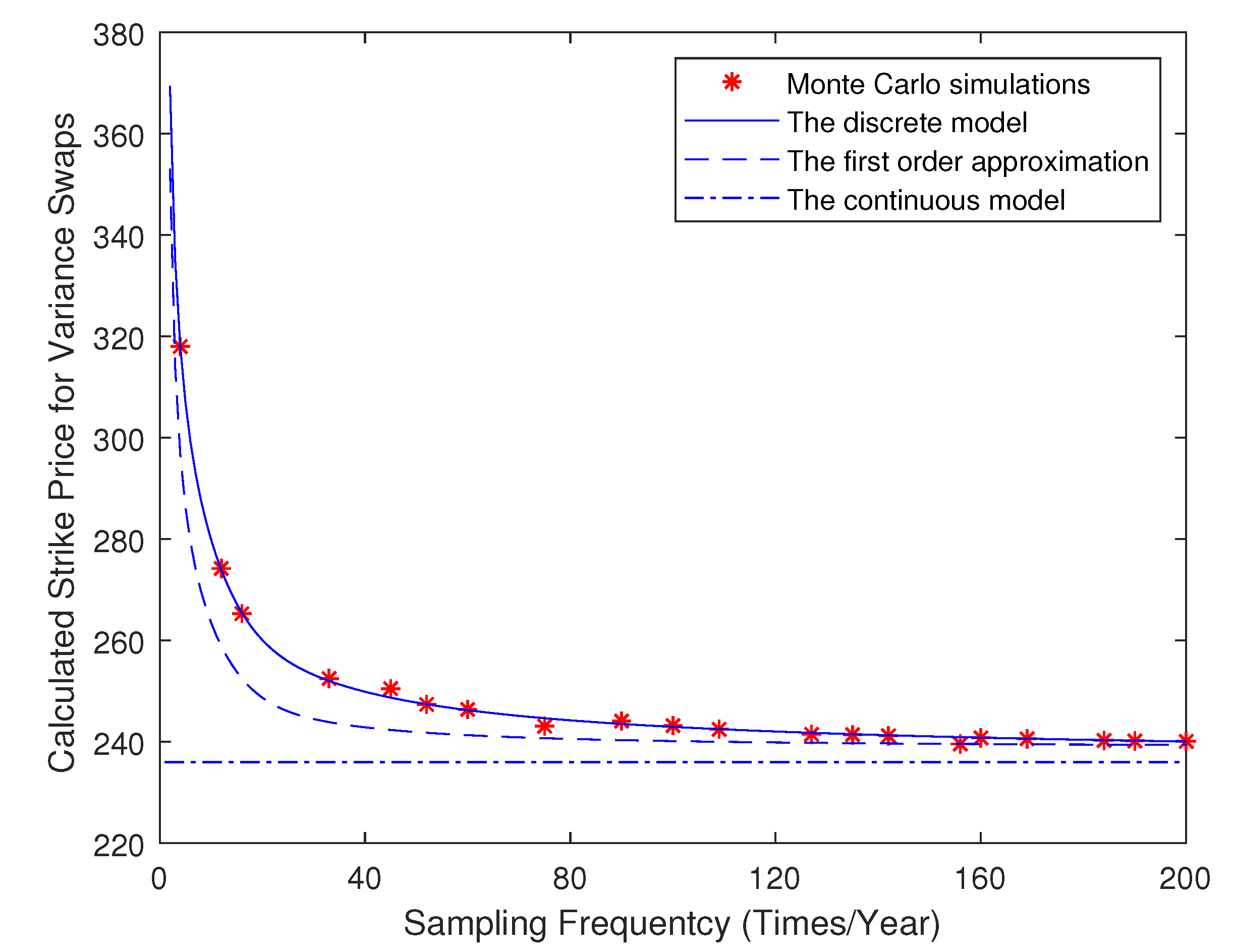

CLOSED FORM PRICING FORMULAS FOR DISCRETELY SAMPLED GENERALIZED VARIANCE SWAPS - Zheng - 2014 - Mathematical Finance - Wiley Online Library

CLOSED FORM PRICING FORMULAS FOR DISCRETELY SAMPLED GENERALIZED VARIANCE SWAPS - Zheng - 2014 - Mathematical Finance - Wiley Online Library

Pricing Options on Realized Variance in Heston Model with Jumps in Returns and Volatility 1 Introduction